Life Insurance in and around Shreveport

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

- Shreveport, LA

- Alexandria, LA

- Ruston, LA

- Little Rock, AR

- Baton Rouge, LA

- Lafayette, LA

- Lake Charles, LA

- Texarkana, TX

- Monroe, LA

It's Time To Think Life Insurance

People sign up for life insurance for a variety of reasons, but the end goal is usually the same: to secure the financial future for the people you're closest to after you die.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

State Farm Can Help You Rest Easy

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If tragedy strikes, Tyler Fredieu stands ready to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

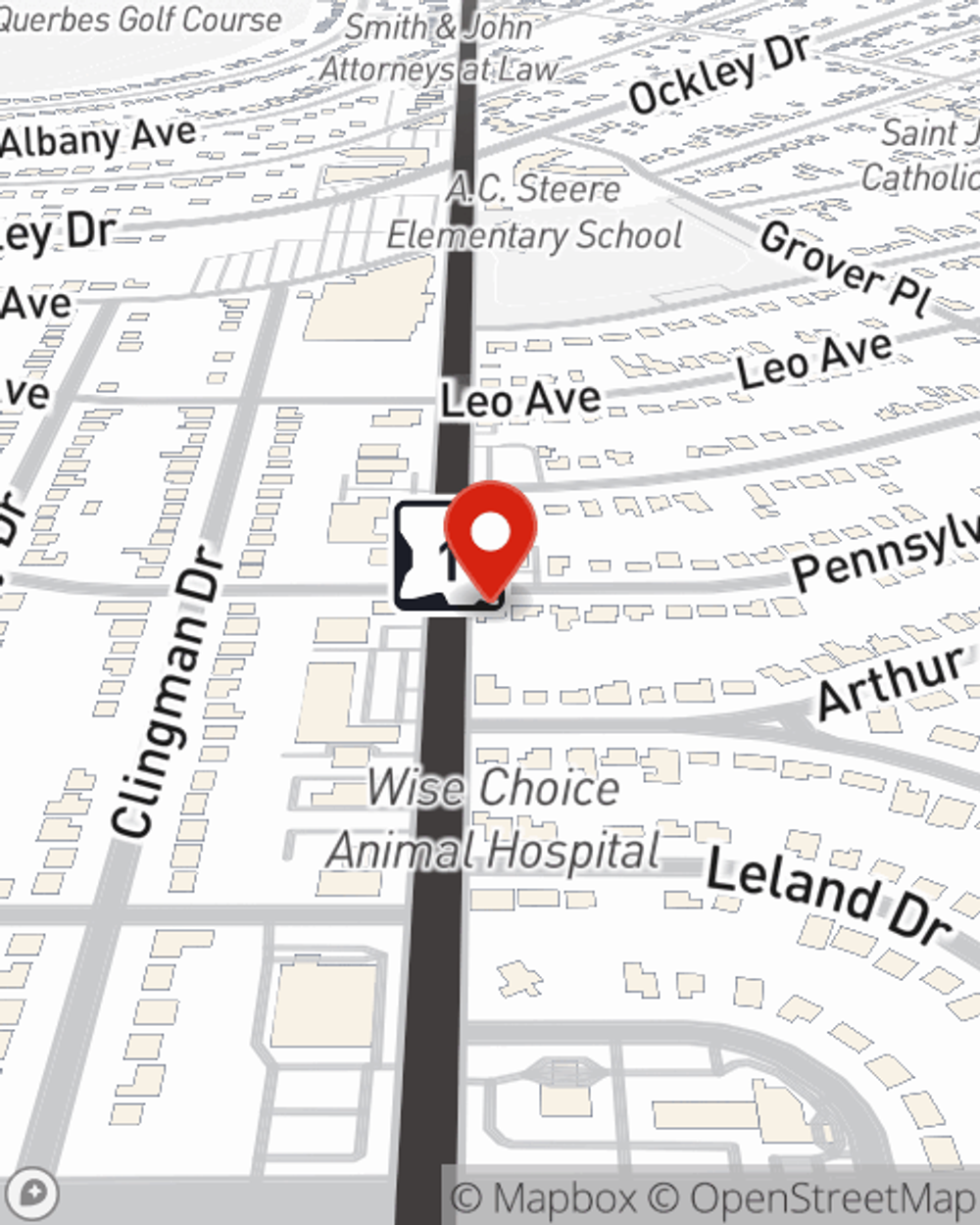

Contact State Farm Agent Tyler Fredieu today to see how a State Farm policy can ease your worries about the future here in Shreveport, LA.

Have More Questions About Life Insurance?

Call Tyler at (318) 869-1697 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Tyler Fredieu

State Farm® Insurance AgentSimple Insights®

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.